1098-T Tax Form

What is a 1098-T Tax Form?

The 1098-T tax form reports the amount paid to Savannah State University over the course of the previous calendar year for qualified tuition and fees. The purpose of the form 1098-T is to help you and/or your tax professional determine if you are eligible for tax credits established by the Internal Revenue Service (IRS).

Online Access to Form 1098-T

Savannah State University offers view access to your 1098-T forms online through a few online resources. All students eligible for a tax form 1098-T for the year will be able to see an electronic version of their form 1098-T online.

Student consent to having their tax form 1098-T electronic on their student account when they log in to view their student account in PAWS. To change their consent, students can go to PAWS, View/ Pay Your Bill, Consents and Agreements, Paperless 1098-Ts, click on the green Change button, and then update their preference. Consents must be solidified by December 31.

Instructions for Accessing your Form 1098-T Tax Notification Online:

There are two ways to access the electronic form.

- Savannah State University's tax partner, Heartland ECSI's, website:

- Go to heartland.ecsi.net

- Click on Help Center

- Click on Accessing Your 1098-T or 1098-E Document

- Click on "Want to look up your 1098-T or 1098-E tax form?"

- Click on "I need my 1098-T Tuition tax statement."

- Type in Savannah State and select from drop box

- Add the required information (Your first and last name, social security number, and zip code at the time you attended Savannah State.)

- Click on Continue

- Select the tax year you wish to view

- Student PAWS account:

- Click on "View and Pay My Tuition Bill"

- Click on "View Statements"

- Click the "Tab 1098-T Tax Statements"

- Select the tax year you wish to view

When will I receive my tax form 1098-T?

Form 1098-Ts will be available online and/or mailed by January 31st of each year.

Qualified tuition and related expenses

Qualified tuition and related expenses are tuition and fees a student must pay to be enrolled at or attend an eligible educational institution. The following are not qualified tuition and related expenses:

-

Amounts paid for any course or other education involving sports, games, or hobbies unless the course or other education is part of the student's degree program or is taken to acquire or improve job skills.

-

Charges and fees for room, board, insurance, medical expenses (including student health fees), transportation (excluding the mandatory Transportation fee required with registration), and similar personal, living, or family expenses.

You should consult with your tax advisor to determine if payments for books, equipment or other fees should be considered when preparing your income tax returns and determining eligibility for education tax credits or deductions.

Why did I not get a 1098-T Tax Form

Savannah State University does not automatically produce 1098-T Tax Forms for students whose Scholarships and Grants (box 5) equal/or exceed their Payments Reportable (box 1) and/or for students who are classified as Non-Resident, Alien. Students in these categories may request a 1098-T Tax Form by emailing bursar@savannahstate.edu and a form will be provided to you.

Additional information

For more information about reporting on Form 1098-T, see Regulations section 1.6050S-1. Also, see Notice 2006-72, 2006-36 I.R.B. 363, available at https://www.irs.gov/irb/2006-36_IRB for guidance in a question and answer format on the information reporting requirements for Form 1098-T.

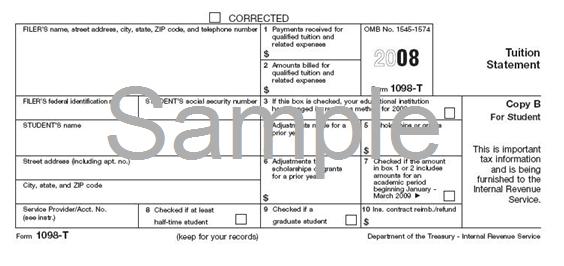

How to Read a Tax Form1098-T:

The Service Provider/Acct. No. box in the lower-left corner of the 1098-T form provides the SSU student identification number.

Box 1: Payments received for qualified tuition and related expenses

This box will contain the sum of all tuition, course fees, and mandatory fees paid towards a student's qualifying charges during a calendar year, less any amounts by which are refunded to the student.

Amounts paid towards a student account for housing, meal plans, parking, health insurance, or other non-required fees will not be included in the Box 1 amount since they are not qualifying charges.

Box 2: Amounts billed for qualified tuition and related expenses

This box will be left blank since the IRS has directed all intuitions to report amounts paid instead of amounts billed.

Box 3: Reporting method

This box will be left blank since SSU has not changed its current method of reporting from the previous year.

Box 4: Adjustments made for a prior year

The amount in this box should be the sum of all reductions in tuition (refunded or not) related to qualified amounts in a prior year. This amount is reported as a positive number per IRS requirements. However, it is actually a decrease to the amount that was reported on a prior year's form.

Box 5: Scholarships or grants

This box contains the sum of all scholarships SSU administered and processed for the student's account during the calendar year. Scholarships that pay for tuition (qualified scholarships) as well as for housing, books, and other expenses (non-qualified scholarships) will be included in this amount. Tuition waivers and payments received from third parties that are applied to student accounts for educational expenses are included in this box, per IRS requirements.

Box 6: Adjustments to scholarships or grants for a prior year

Decreases or refunds of scholarship amounts related to scholarships reported in a previous year are included in this box. This amount is reported as a positive number per IRS requirements. However, it is actually a decrease to the amount that was reported on a prior year's form.

Box 7: January- March periods

This box will be checked if the amount reported in Box 1 includes tuition or qualified amounts paid towards a student account in the current year that pay for a semester beginning in the next calendar year.

For example, tuition billed in December 2009 for Spring 2010 and paid for in December 2009 will be reported on a 2009 form 1098-T. Box 7 will be checked to indicate that this is the case.

Box 8: Half-time Enrollment

A check in this box indicates that you are or have been enrolled at SSU at least half-time for at least one semester during the calendar year.

Box 9: Graduate Student

This box will be checked if you are a student enrolled in a program leading to a graduate-level degree.

Box 10: Reimbursements/Refunds

This box will be left blank, since SSU's system currently does not support this reporting.

For questions pertaining to your personal form, please email us at bursar@savannahstate.edu.